Since the beginning of this year the Department of Work and Pensions (DWP) have been refusing to respond to requests for information about companies using the various government workfare schemes. In August, the Information Commissioner told DWP that names of companies must be released, but the DWP responded by saying that if they were to comply with the law then the entire workfare scheme would collapse.

Since the beginning of this year the Department of Work and Pensions (DWP) have been refusing to respond to requests for information about companies using the various government workfare schemes. In August, the Information Commissioner told DWP that names of companies must be released, but the DWP responded by saying that if they were to comply with the law then the entire workfare scheme would collapse.

Given that the £5bn scheme has been shown to be a complete failure, with success rates lower than actually doing nothing at all, you might think that the Government would leap at this golden opportunity to rid itself of such a failed and unpopular policy. But no, instead the DWP will carry on regardless, and in order to keep its dealings behind closed doors for a wee while longer, has decided to appeal against the Commissioners verdict. http://www.guardian.co.uk/politics/2012/nov/09/mandatory-work-activity-names-witheld

In Scotland, the mandatory work programmes have only found jobs for 3,320 people ( approx 3.7% of those taking part) once their workfare placement ended. It is not clear how many of these jobs are actually ongoing or long-term.

Following Public Accounts Committee grillings of mega-wealthy multinationals Google, Amazon and Starbucks over tax avoidance, HMRC have entered into private discussions with these businesses to determine just how much tax they would like to pay in future.

Starbucks, who have only managed to contribute $8.6million in UK tax on sales of £3.1bn in their 13 years of operation here, are now able to claim that they have reached a deal with HMRI which will see them make some changes to their accounting procedures. The detail however is not available to public scrutiny. Will all the corporation tax which should have been paid over these 13 years now be paid. We don’t know for sure (its a secret), but we can make guess that it won’t be.

Starbucks, who have only managed to contribute $8.6million in UK tax on sales of £3.1bn in their 13 years of operation here, are now able to claim that they have reached a deal with HMRI which will see them make some changes to their accounting procedures. The detail however is not available to public scrutiny. Will all the corporation tax which should have been paid over these 13 years now be paid. We don’t know for sure (its a secret), but we can make guess that it won’t be.

We do know however that on Monday 3rd December, Starbucks changed their terms of employment for all workers. Cuts to paid lunch breaks, sick leave and maternity benefits were all to be implemented. http://www.guardian.co.uk/business/2012/dec/03/starbucks-slash-lunch-breaks

If you tax us we’ll undermine our employees rights rather than fractionally reduce our profits and the dividends paid to shareholders is clearly the company position.

It’s not just the state that loves secrecy of course. It’s how all global corporations get away with contributing next to nothing to the countries where they locate. Financial transfers within the corporations are hidden in their internal accounts and are untouchable by the tax man. Starbucks (UK), for instance, buy ALL their coffee, at great expense, from that well known coffee producing country Switzerland. Actually they buy it (deliberately overpriced) from a Starbucks subsidiary in Switzerland which pays a 5% tax rate compared to a 24% tax rate if it was accounted for in the UK.

It is a profit maximisation scheme, as is their other internal scam which sees Starbucks(tax haven) lend huge sums to Starbucks (UK) thus allowing the UK bit of the operation to deduct interest on the “loan” from their UK tax liability. This is not only legal, it is the way that all global corporations operate. Its’s not an aberration – it’s the SYSTEM. It’s wrong, it’s immoral and it’s fundamentally responsible for the worldwide austerity programmes which hit the most vulnerable in our societies while $30trillion sits in offshore tax havens.

What can we do about it? Quite simply we must continue to Organise, Agitate and Educate. Pressure has been mounting over the last two years as more and more people question the entire structure of global capital. Direct action, by UKUncut, Occupy and Boycott Workfare campaigners, has been successful in naming and shaming big business. Lets keep up the pressure:

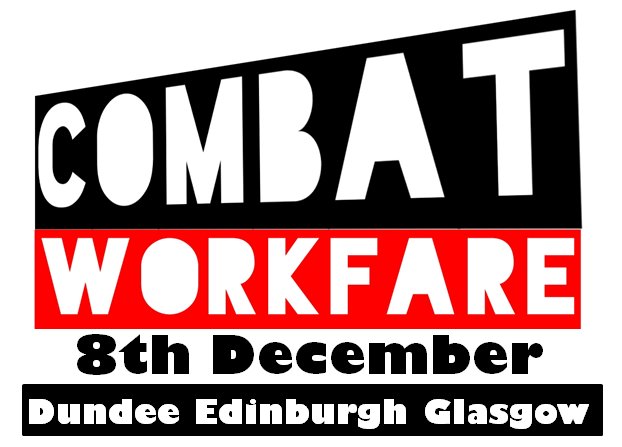

Demonstrate 1pm Boots Corner, City Centre, Dundee on Saturday 8th December. http://www.facebook.com/?ref=tn_tnmn#!/events/113882218773754/

Happy to join you all in Edinburgh my friends you can also find me on twitter @susanas4321